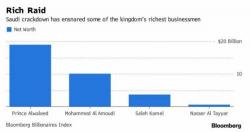

One day after we reported that Saudi Arabia has started to freeze the accounts of the dozens of arrested royals, ministers and businessmen, in the process allowing Mohammed bin Salman to further cement control over the Kingdom, the Kingdom has taken its "money laundering" crackdown to the next level and on Tuesday, Saudi banks have frozen more than 1,200 accounts belonging to individuals and companies in the kingdom as part of the government’s anti-corruption purge, bankers and lawyers told Reuters, adding that "the number is continuing to rise."