Chinks In The Armor (And How To Protect Your Portfolio From A Market Decline)

Authored by Bryce Coward via Knowledge Leaders Capital blog,

Authored by Bryce Coward via Knowledge Leaders Capital blog,

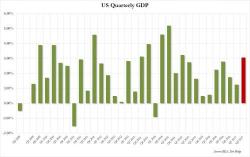

With just two days left until the end of the third quarter, what happened in Q2 will hardly provoke a market reaction, which is why when the BEA announced that the third and final Q2 GDP print was revised from 3.0% to 3.1%, (or specifically from 3.049% to 3.06%) it hardly inspired a move in risk assets, even though it did come in fractionally better than the 3.0% expected, and more than double the 1.2% Q1 GDP print.

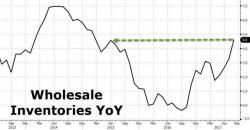

Wholesale Inventories jumped 1.0% MoM in August, the fourth consecutive build in inventories in a row and the fastest monthly build since Nov 2016.

This is the fastest annual growth rate for inventories since June 2015 as it appears producers embrace the idea that 'if they build it, they will come'.

Perhaps most notably, motor vehicles saw the biggest rise (+1.2% MoM, +7.4% YoY) as sales collapse.

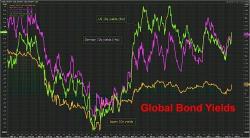

As noted earlier, the return of the "Trump Trade", however brief, on the back of tax reform euphoria and Hawkish Yellen has dominated market sentiment, resulting in the latest bond market "crash", sending yields to a nearly three month high of 2.35% earlier this morning, and as Bill Blain showed in a chart, it took just three weeks to reverse the fall we saw in July and August, up 30bps in days, while Bunds are up 20bp and even JGBs are up 5bp (far greater rises in relative terms).

In a continuation of trading patterns observed over the previous two days, on Thursday the global bond rout deepened in the aftermath of the release of President Trump’s tax-cut plan, Janet Yellen's recent hawkish comments and renewed optimism over the health of the U.S. economy.