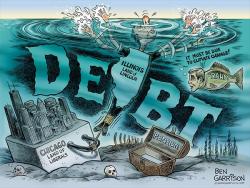

This $5 Trillion Time Bomb Will Devastate Americans

Authored by Nick Giambruno via InternationalMan.com,

Over 3,000 millionaires have fled Chicago in recent months.

This is the largest outflow of wealthy people from any US city right now. It’s also one of the largest outflows of wealthy people in the world.

But it’s not just millionaires… Every five minutes someone leaves Illinois.