The Madness Is Back: Homeowners Take Out Mortgages To Buy Bitcoin, Cars And Wine

It's been about a decade since the term "mortgage arbitrage" made headlines. It's back.

It's been about a decade since the term "mortgage arbitrage" made headlines. It's back.

Authored by Teddy Vallee via Pervalle.com,

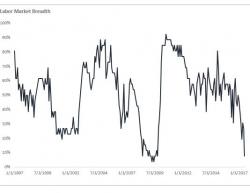

Tom Keene was out with a chart today referencing Zerohedge’s point that a large percentage of the non-farm payroll growth has been a result of lower paying industries, such as food and drinking places – or as they would put it, more bartenders.

the acclaimed @zerohedge chart on bartenders: pop adjust food&drinking...the NFP growth from the 2007 peak i'll take the delta on the rocks pic.twitter.com/yL2DAiqfjy

With the dollar index now 10 points below its recent cycle highs from early January, nervous dollar bulls are starting to reevaluate their initial assumption that this would be a short-term pullback, and many are worried that this could be the start of a new secular bear market.

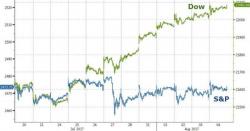

While all eyes have been focused on the incessant rise in the price-weighted farce known as The Dow Jones Industrial Average, a funny thing happened in the 'real' market...

The S&P 500 went nowhere... 2474, 2473, 2473, 2470, 2477, 2478, 2475, 2472, 2470, 2476, 2478, 2472, 2477...

How unusual is this? Simple - it's never, ever (in 90 years of S&P history) happened before...

Since The Fed (et al.) began tinkering (red shaded box), markets have slowly (and now quickly) died.

Via Jesse's Cafe Americain blog,

Apparently the Banks have been lobbying heavily, and expending significant amounts of money again, leaning on their Congressmen and pressuring regulators, saying that their capital standards need to be relaxed so that they can make more loans to stimulate economic growth.

But that, according to the FDIC Vice-Chairman, is utter nonsense.