Yanking The Bank Of Japan's Chain - "It's Basic Math, Stupid!"

Authored by EconomicPrism's MN Gordon, annotated by Acting-Man's Pater Tenebrarum,

Mathematical Certainties

Authored by EconomicPrism's MN Gordon, annotated by Acting-Man's Pater Tenebrarum,

Mathematical Certainties

It's been about a decade since the term "mortgage arbitrage" made headlines. It's back.

Authored by Teddy Vallee via Pervalle.com,

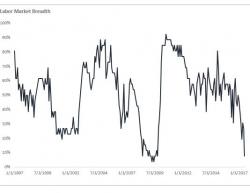

Tom Keene was out with a chart today referencing Zerohedge’s point that a large percentage of the non-farm payroll growth has been a result of lower paying industries, such as food and drinking places – or as they would put it, more bartenders.

the acclaimed @zerohedge chart on bartenders: pop adjust food&drinking...the NFP growth from the 2007 peak i'll take the delta on the rocks pic.twitter.com/yL2DAiqfjy

With the dollar index now 10 points below its recent cycle highs from early January, nervous dollar bulls are starting to reevaluate their initial assumption that this would be a short-term pullback, and many are worried that this could be the start of a new secular bear market.

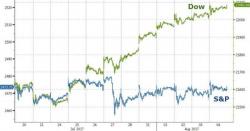

While all eyes have been focused on the incessant rise in the price-weighted farce known as The Dow Jones Industrial Average, a funny thing happened in the 'real' market...

The S&P 500 went nowhere... 2474, 2473, 2473, 2470, 2477, 2478, 2475, 2472, 2470, 2476, 2478, 2472, 2477...

How unusual is this? Simple - it's never, ever (in 90 years of S&P history) happened before...

Since The Fed (et al.) began tinkering (red shaded box), markets have slowly (and now quickly) died.