From Jihad To Jobs, Paul Craig Roberts Says "Fakes News Is A US Media Specialty"

Authored by Paul Craig Roberts,

The American media specializes in fake news.

Indeed, since the Clinton regime the American media has produced nothing but fake news.

Authored by Paul Craig Roberts,

The American media specializes in fake news.

Indeed, since the Clinton regime the American media has produced nothing but fake news.

Authored by Kevin Smith, Tavi Costa, and Nils Jensen via Crescat Capital,

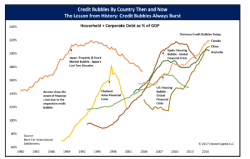

Crescat Capital's Q2 letter to investors shouold be retitled "everything you wanted to know about the looming bursting of the world's biggest credit bubble... but were afraid to ask..." Don't say we didn't warn you...

Authored by David Stockman via The Daily Reckoning,

Here’s a comparison that is surely vertigo inducing.

There are roughly 76 million Baby Boomers in the United States that are about to transition out of the highest wage earning years of their lives and into retirement where they'll be making precisely nothing. Unfortunately, as MarketWatch points out today, those Baby Boomers are woefully unprepared for what awaits them.

Authored by EconomicPrism's MN Gordon, annotated by Acting-Man's Pater Tenebrarum,

Mathematical Certainties