King Dollar testing triple support with few bulls!

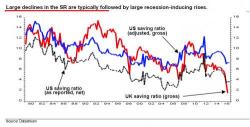

King Dollar over the past 30-weeks has experienced a sizable decline, that hasn’t a ton of times over the past 25-years, see below-

CLICK ON CHART TO ENLARGE

The large decline in King Dollar has taken it down to what could be an important price point and it has impacted sentiment a good deal as well.