"Like A Wrecking Ball..."

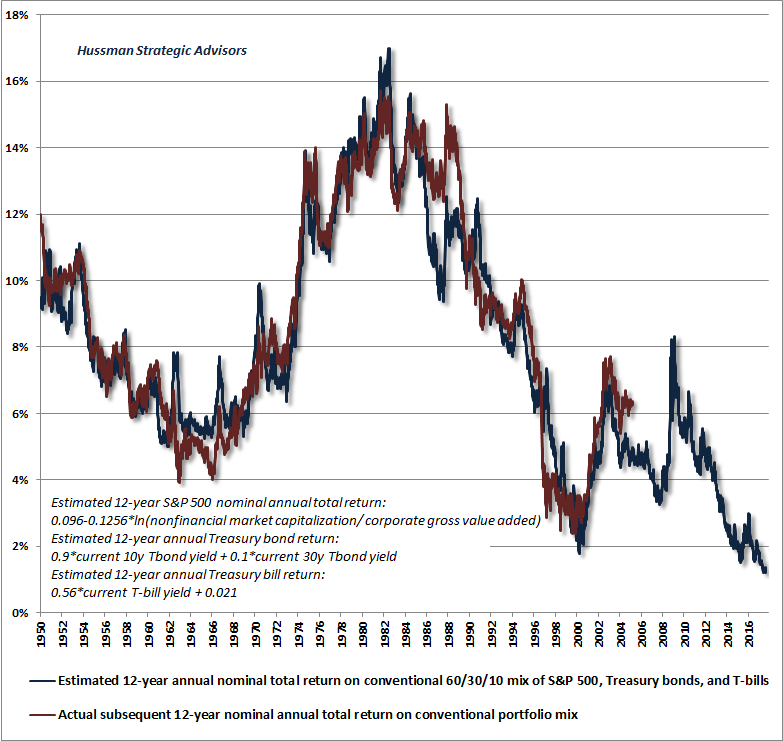

Excerpted from John Hussman's Weekly Market Comment...

...

Excerpted from John Hussman's Weekly Market Comment...

...

Investors piled $2.7 billion into QQQ (the benchmark ETF tracking the Nasdaq 100 Index) in the five days through July 14 as shares in the fund posted their biggest advance this year.

As Bloomberg notes, the biggest weekly inflow since September 2010 came as the tech-heavy index - with megacaps Apple, Amazon, Facebook, and Alphabet among its largest members - rebounded to within 1 percent of its record high.

Two months after the Fed fined Deutsche Bank a paltry $157 million for manipulating currency markets after the German bank's traders were found to be using "chat rooms" to rig FX trading, we learn that there was more gambling going on here, and on Monday the Fed announced that it will fine French BNP Paribas $246 million "for the firm's unsafe and unsound practices in the foreign exchange (FX) markets."

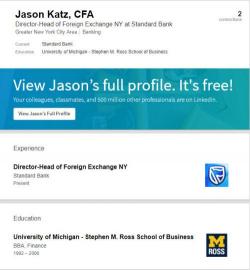

Authored by Lance Roberts via RealInvestmentAdvice.com,

This past week, the lovely, and talented, Danielle DiMartino-Booth and I shared a discussion on the ongoing debate of why “Rates Must Rise.”

Debt drives rates lower....not higher. Debt is deflationary. See chart below and read this: https://t.co/jHAcnuGTit pic.twitter.com/tM2a5BrIiO

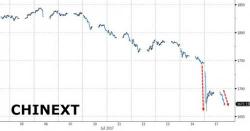

Early this morning, we discussed the unexpected tumble in the Chinese small-cap stock index, the ChiNext, will plunged by over 5%...

... as a result of growing concerns that a new round of deleveraging is about to be imposed by Beijing following the conclusion of China’s 5th National Financial Work Conference (NFWC), which was attended by president Xi Jinping, and set the agenda for critical financial reforms over the coming years. As the People's Daily noted on Monday: