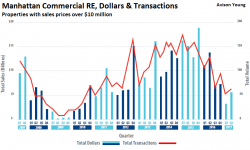

What’ll Happen to US Commercial Real Estate as Chinese Money Dries Up?

In the second quarter in Manhattan, Chinese entities accounted for half of the commercial real estate purchases with prices over $10 million. By comparison, in 2011 through 2014, total cross-border purchases from all over the world (not just from China) were in the mid-20% range.

“At a time when domestic investors have pulled back, foreign parties have ramped up their holdings in Manhattan,” according to Avison Young’s Second Quarter Manhattan Market Report.