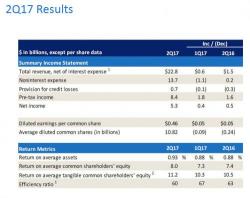

BofA Beats Despite 14% Slump In FICC Revenue; Interest Income Unexpectedly Declines

Echoing the trend set by JPM and Wells Fargo last Friday, moments ago Bank of America reported revenue and earnings that modestly beat expectations, with Q2 revenue of $22.8bn, above the $21.8bn expected, generating net income of $5.3 billion up 10% Y/Y, and EPS of $0.46, above the $0.43 estimate, and 12% higher than Q2 2016.