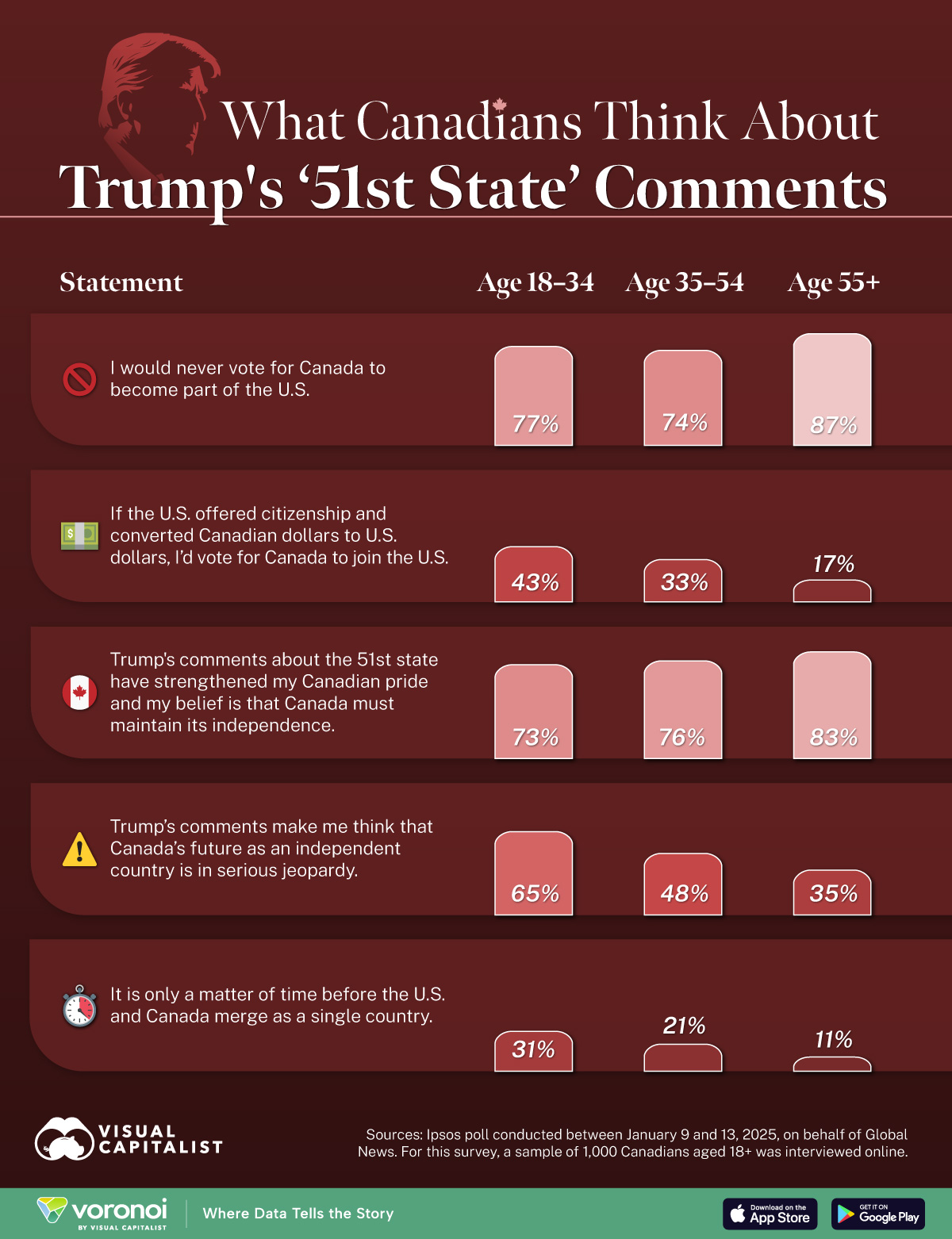

What Canadians Think About Trump’s ‘51st State’ Comments

![]()

See this visualization first on the Voronoi app.

What Canadians Think About Trump’s ‘51st State’ Comments

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.