The Hidden Agenda Behind Saudi Arabia’s Market Share Strategy

Submitted by Dalan McEndree via OilPrice.com,

Submitted by Dalan McEndree via OilPrice.com,

By Monique Muise, as published on Global News

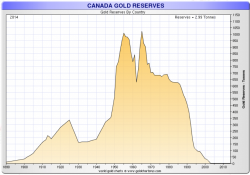

Canada sells nearly half of all its gold reserves

The government of Canada sold off nearly half its gold reserves in recent weeks, continuing a pattern of moving away from the precious metal as a government asset.

According to the International Monetary Fund’s International Financial Statistics, Canada held three tonnes of gold reserves as of late 2015.

http://globalnews.ca/video/embed/2511836/

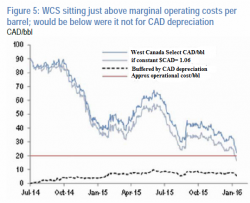

We’ve spilled quite a bit of digital ink documenting the trials and travails of Alberta, the heart of Canada’s dying oil patch and ground zero for the pain inflicted by 14 months of crude carnage.

At the risk of beating a dead (or at least a “dying”) horse, you’re reminded that violent crime is soaring in the province, suicide rates are up by a third as is food bank usage, and as for unemployment, well, Alberta lost 19,600 jobs last year - the most in 34 years.

Back in the summer of 2011, when we reported that Canadian banks appear dangerously undercapitalized on a tangible common equity basis...

... the highest Canadian media instance, the Globe and Mail decided to take us to task. To wit:

Were the folks at Zerohedge.com looking at the best numbers when they argued that Canadian banks were just as levered as troubled European banks?

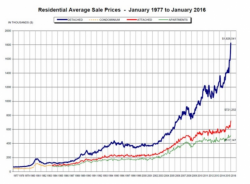

Last week we identified a “bargain” in Canadian real estate.

As you might recall, the Canadian economy is in a bit of a tailspin, and that goes double for the country’s dying oil patch. Indeed, we’ve documented Alberta’s painful experience with slumping crude exhaustively, noting that the steep decline in oil prices has triggered job losses (which hit their highest level in 34 years in 2015), depression, suicides, soaring food bank usage, and a marked uptick in property crime.