US Housing Market Reeling After Mortgage Rates Jump To Two Years Highs

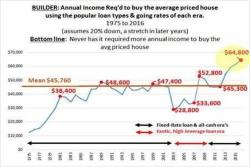

Ten days ago, we wrote that the "US Housing Market In Peril As "Increase In Mortgage Rates Has Shocked Consumers." Fast forward to today when the same "shocked consumers" referenced in the WSJ piece must be on the verge of a nervous breakdown because according to the Mortgage Brokers Association, rates on US fixed-rate mortgages rose to their highest levels in more than two years, sending weekly home loan application activity to its weakest since early January, according to the latest MBA data.