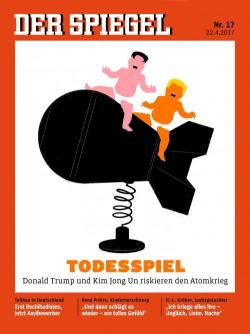

Trump To Hold Top Level Briefing On North Korea Following US Citizen Arrest

Shortly after the news that later on Sunday, president Trump would hold a phone call with China president Xi and Japan's PM Abe, the White House said in an advance schedule that on April 26 it will hold a briefing for senators with its “four principals” on North Korea "as the administration considers its options for dealing with saber-rattling from Pyongyang" according to Bloomberg. Among those present will be Secretary of State Rex Tillerson, Defense Secretary Jim Mattis, Director of National Intelligence Dan Coats and Joseph Dunford, chairman of the Joint Chiefs of Staff.