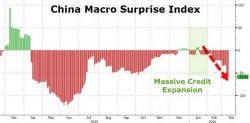

After January Scramble, Chinese Lending Collapses

After January's record-smashing CNY3.4 trillion (half a trillion dollars!) surge in aggregate credit expansion in China, the post-lunar-new-year hangover hit hard in February as credit growth tumbled 77% from Janaury's level to just CNY780 ($112bn). This is the weakest February loan growth since 2011. Drastically missing expectations, and following authorities comments on the need to "monitor" excess credit growth, all categories of total social finance registered a sharp drop.