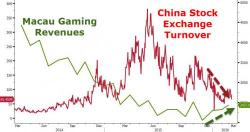

China's Gamblers Ditch The Burst Stock Bubble, Return To Macau's Casinos

China's plunge protection team may be scrambling to prop up the Shanghai Composite for the duration of the People's Congress, but the moment the NPC is over, the stock "market" goes with it, and the people know it. But now that China has its favorite bubble back - housing - few care: after all the stock bubble was meant purely as a placeholder until houseflipping mania returns.