China's Mass Unemployment Wave Begins: Six Million Workers To Get Pink Slips

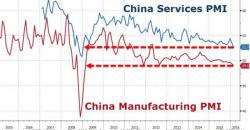

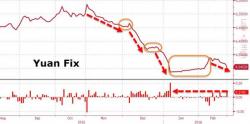

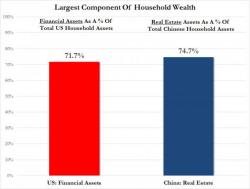

Back in November, just as the world's attention was focusing on China for long-overdue reasons including a slowing economy, debt at well over 300% of GDP, an artificially high exchange rate whose devaluation is causing market shockwaves around the globe, a reflating housing bubble, a burst stock market bubble and non-performing loans, as high as 20%, when we pointed out the one "most under-reported" risk virtually nobody was talking about: Chinese employment.