Mapped: The World’s Countries Compared by 20 Key Metrics

https://player.vimeo.com/video/777364163

https://player.vimeo.com/video/777364163

Mapped: The World’s Countries Compared by 20 Key Metrics

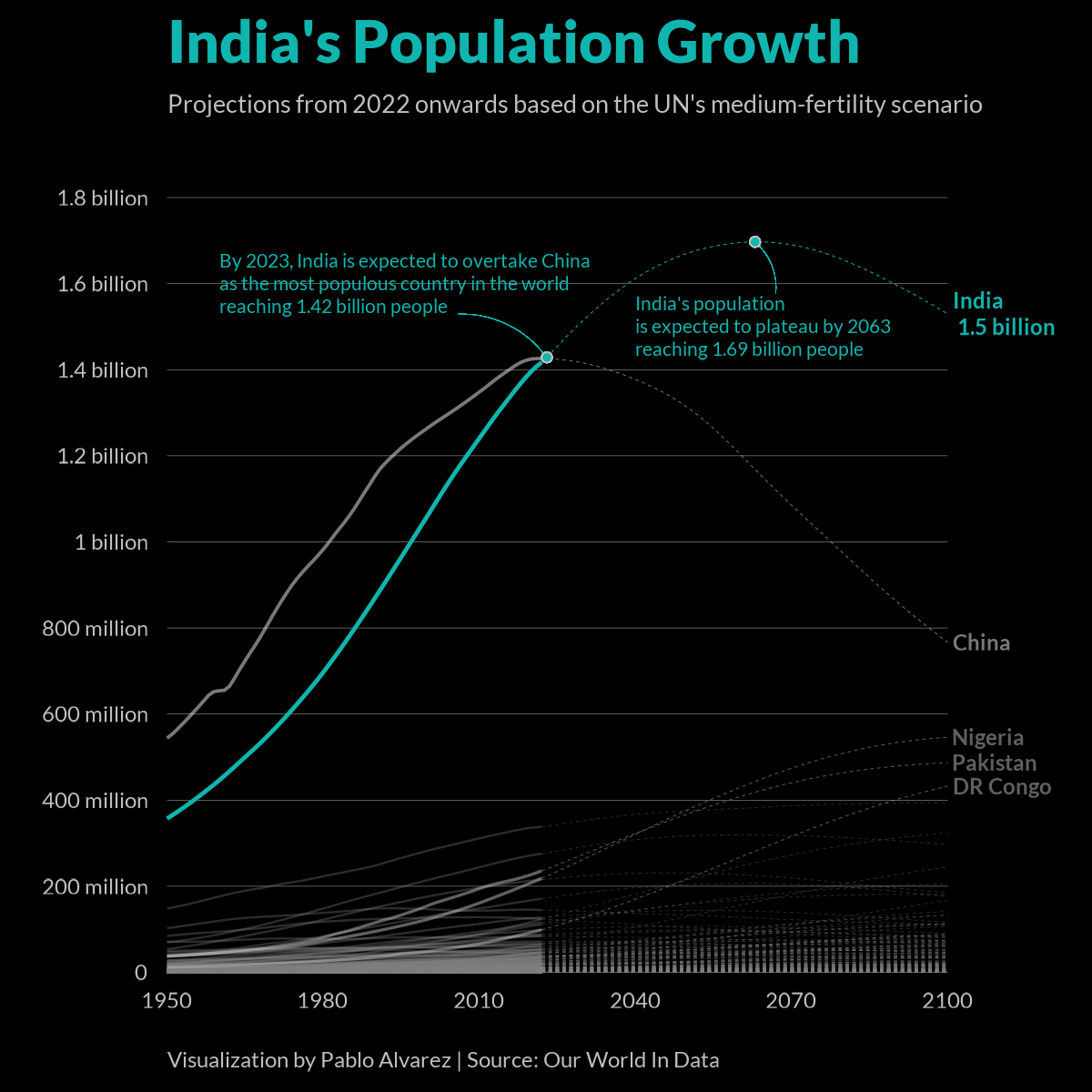

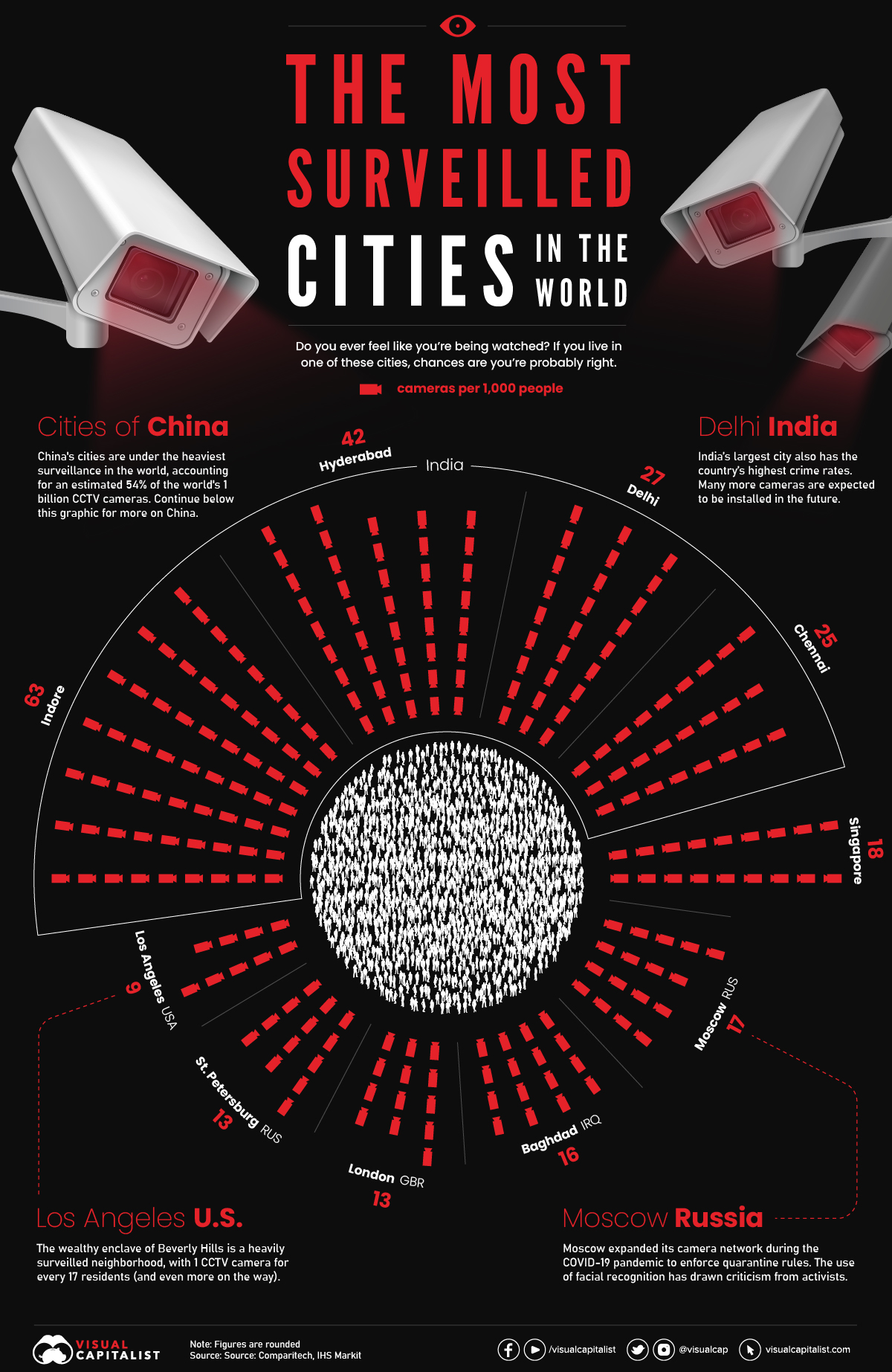

Which countries have the largest populations? What about the rural versus urban population divide? And which countries have the highest Gross Domestic Product (GDP), military expenditures, or tech exports?