Q1 2016: Gold Glows Amid The Greatest Stock Market Comeback In The History Of Investing

He does it again pic.twitter.com/VxemrcowNf

— zerohedge (@zerohedge) March 31, 2016

The market ended red today...

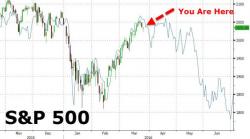

But The Dow and The S&P ended Q1 in the green after a yuuge drop...

In fact this was the greatest comeback in the history of stocks... (Q1 2016's 11.3% drawdown is the biggest on record for a quarter that ended green)