Is Market Breadth Beginning To Sour?

Via Dana Lyons' Tumblr,

Despite positive action in the major averages, market breadth has very recently begun to lag.

Via Dana Lyons' Tumblr,

Despite positive action in the major averages, market breadth has very recently begun to lag.

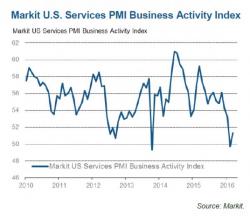

One again it was a "good cop, bad cop" combination of the Markit and ISM service surveys.

First, it was Markit, which printed at the just barely expansionary Final March print 51.3, up from the preliminary 51.0, but the internals continued to deteriorate. As the chart below shows, and as the commentary confirms, the US service sector is barely hanging on by a thread.

Some of the highlights:

Dy Dana Lyons of My401kPro.com

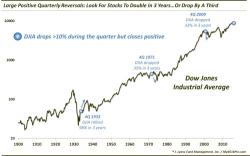

Stocks Should Double In 3 Years (…Or Drop By A Third)

In our April 1st Chart Of The Day, we showed that the Dow Jones Industrial Average (DJIA) did something that it has only done 3 other times since 1900. After dropping over 10% during the quarter, it recovered to close the quarter positive.

"Off the lows"...

So this just happened...

But it doesn't really matter when all it takes is a phone call...

Post-Payrolls, stocks faded until the US open, and then took off...

Via Dana Lyons' Tumblr,

The 2nd quarter of election years has the worst average historical return of the 4-year Presidential Cycle.