Stocks Soar As Corporations Are Defaulting On Their Debts Like It's 2008 All Over Again

Submitted by Michael Snyder via The Economic Collapse blog,

Submitted by Michael Snyder via The Economic Collapse blog,

If asking traders where stocks and oil would be trading one day after a weekend in which the Doha OPEC meeting resulted in a spectacular failure, few if any would have said the S&P would be over 2,100, WTI would be back over $40 and the VIX would be about to drop to 12 and yet that is precisely where the the S&P500 is set to open today, hitting Goldman's year end target 8 months early, and oblivious of the latest batch of poor earnings news, this time from Intel and Netflix, both of which are sharply down overnight.

Was it ever in doubt?

Oh just one thing...

Earnings expectations have plunged over 6% since the last time The Dow was here.

Chart: Bloomberg

By the SRSrocco Report

Something big happened in the gold market. It was a stunning trend change in mainstream gold demand during the first quarter of the year. This suggests investors are becoming increasingly worried about the stock markets and are looking for safety elsewhere.

Over the past several years, the gold market has suffered net outflows of metal from Gold ETF's & Funds. However, this changed in a big way in Q1 2016:

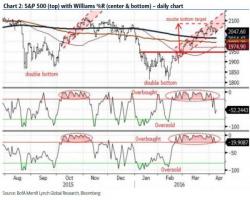

The stock surge from February is at risk, warns BofAML's Stephen Suttmeier as a plethora of bearish divergences could cap further gains from here. 2044-2022 are key nearby S&P 500 support for April, but a loss of 2022 is required to break the last higher low from 3/24 and suggest a deeper decline for the S&P 500. The following 15 risk-factors - from VIX term structure steepness to Dow Theory Sell signals - all point to a retest of the recent 1810-1820 lows.