Stocks Dazed After Trump NAFTA Flop, Tax Plan Disappointment; ECB Looms

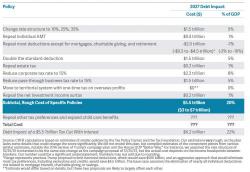

European shares are lower, pressured by disappointing results by Deutsche Bank and ending a six-session gain, as Asian equities and S&P futures were little changed after a record-setting rally in world stocks which pushed the MSCI World index to over $50 trillion yesterday, fizzled after Trump released unconvincing tax cut plans prompting traders to "sell the news" while caution set in as the ECB met.