The Coming Bear Market

Via NorthmanTrader.com,

Via NorthmanTrader.com,

With both volatility and asset correlations near all time lows...

... and complacency dominating across all global markets, one BlackRock money manager warns that investors should probably be a little more nervous.

Even as the recent stock surge and below-average volatility show investor optimism is near all time highs, markets are underpricing global political risks, said Russ Koesterich, who helps manage the $41 billion BlackRock Global Allocation Fund.

In a fiery speech delivered in London aimed to show U.K. Prime Minister Theresa May that she won’t get everything her own way, former British Prime Minister Tony Blair Tony Blair urged opponents of Brexit to “rise up” and fight to change the British people’s minds about leaving the European Union.

http://www.bloomberg.com/api/embed/iframe

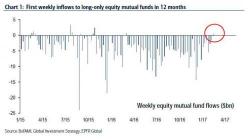

Finally some good news for active managers. After one year of consecutive outflows, last week saw the first inflows into long-only equity mutual funds going back to last February, as according to BofA there finally was a $0.5 billion cash inflow, "a sign of rising investor confidence & broadening participation in equity rally." However, to put this number in context, at the same time inflows to ETFs amounted to $17.2 billion, some 35 time more.

BofA's Michael Hartnett summarizes the latest fund flows in two words: "Risk-on."

S&P equity futures followed Asian and European stocks lower, driven by weakness in Franch and Italian markets, as French political concerns returned; the pound tumbled after UK monthly retail sales unexpectedly dropped pushing the dollar higher and Euro lower.