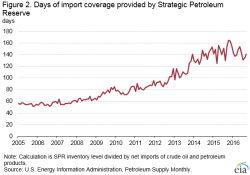

U.S. Prepares To Sell Off Its Oil Reserves

Submitted by Nick Cunningham via OilPrice.com,

The U.S. is beginning to wind down one of the core energy security policies of the past half century as the boom in domestic drilling eases concerns about supply.

(Click to enlarge)