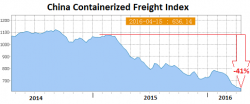

China Ocean Freight Index Collapses to Record Low

Wolf Richter wolfstreet.com

The amount it costs to ship containers from China to ports around the world, a function of the quantity of goods to be shipped and the supply of vessels to ship them, just dropped to a new historic low.