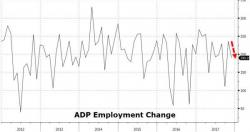

Zandi Warns "Job Market Feels Like It Might Overheat" As Manufacturing Jobs Grow At Fastest Pace On Record

Following October's better-than-expected surge in ADP employment data (as goods-producing jobs soared), November was expected to see some slowdown, and it did, printing right on expectations at +190k (close to NFP's 195k exp).

“The labor market continues to grow at a solid pace,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute.