"Excessive Pockets Of Gluttony": Meet PA's Public Pensioners Making $500,000 A Year Courtesy Of Taxpayers

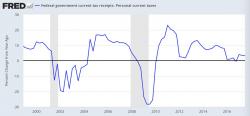

Liberal politicians in Washington D.C. often complain about the federal tax code being too regressive and thus placing too large a burden on low-income families while allowing "millionaire, billionaire, private jet owners" to get a free pass (one must to be willing to ignore actual statistics to reach this conclusion but lets just take the word of Bernie Sanders at face value for the moment).