China Surge, Rising Oil Push Global Stocks Higher; S&P Futures Flat As Fed Minutes Loom

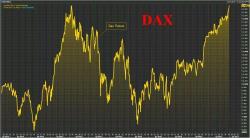

European stocks rebounded after a downbeat start, aided by a return to the post-Euro open momentum ignition in the USDJPY while Asian stocks rose after China shares surged 1.5%, the most since August. For now S&P futures are fractionally in the red, although we expect them to turn progressively higher as US traders get to their desks to frontrun the now traditional "post open" ramp.