This article is an excerpt of a members only VC+ Special Dispatch. Join VC+ to unlock the full analysis.

Use This Visualization

Prediction Consensus: 2025 Midyear Update

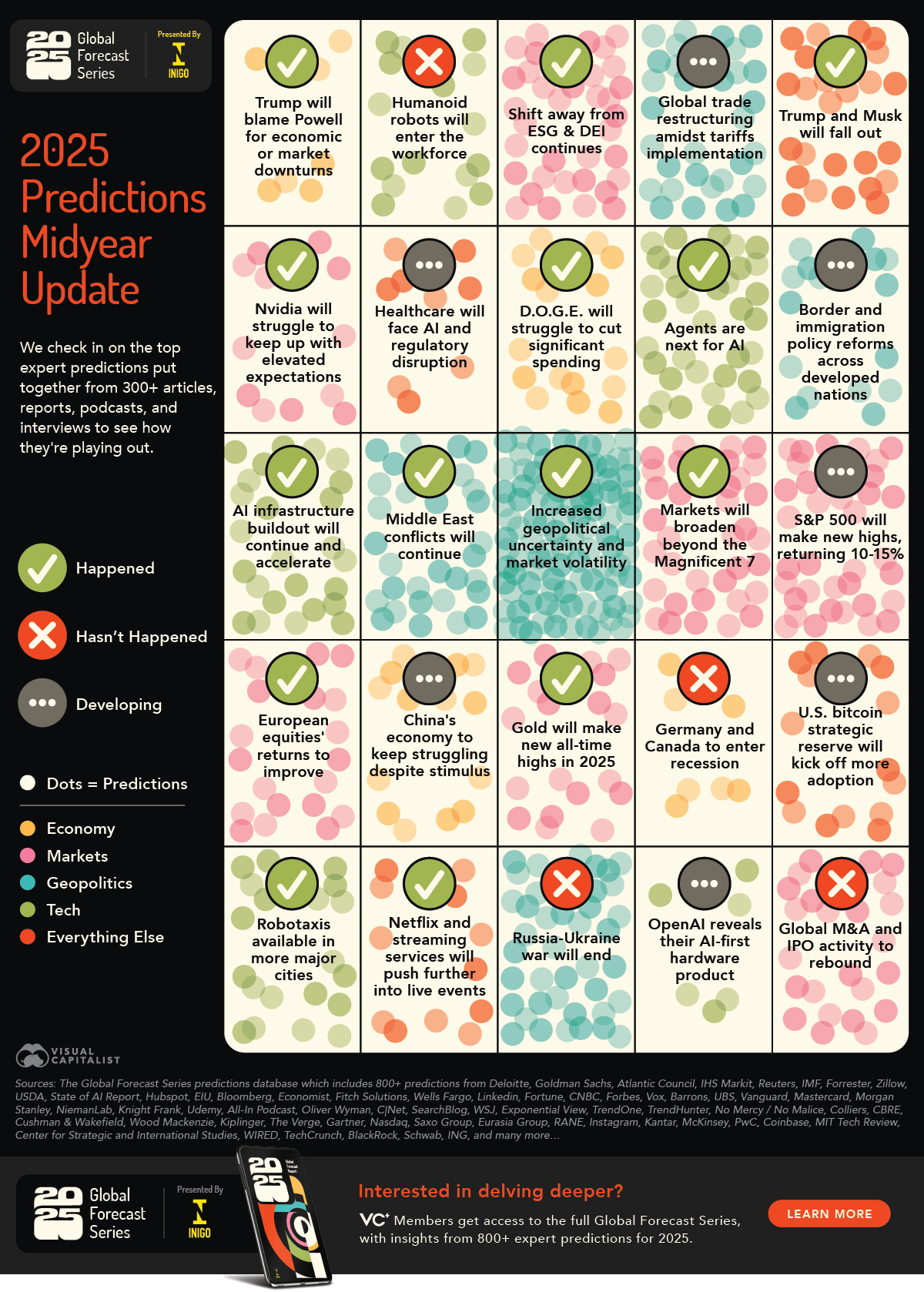

Each year, our editorial team at Visual Capitalist sifts through hundreds of reports and articles to put together our Prediction Consensus, an aggregation of everything that experts predict for the year ahead.

Almost halfway through 2025 now, it’s time to see how these predictions are holding up. From Trump’s friendships and feuds to geopolitical uncertainty and market volatility, many expert predictions have already come true.

Along with the update of our Prediction Consensus bingo card above, this article dives into the most notable developments with visuals breaking them down.

This article is an excerpt from the latest VC+ Special Dispatch. Join VC+ to access the full version, packed with more expert predictions and exclusive visuals. And for a limited time, get VC+ for life with a one-time payment. Hurry—offer ends in a few days.

Presidential Predictions and D.O.G.E. Cuts

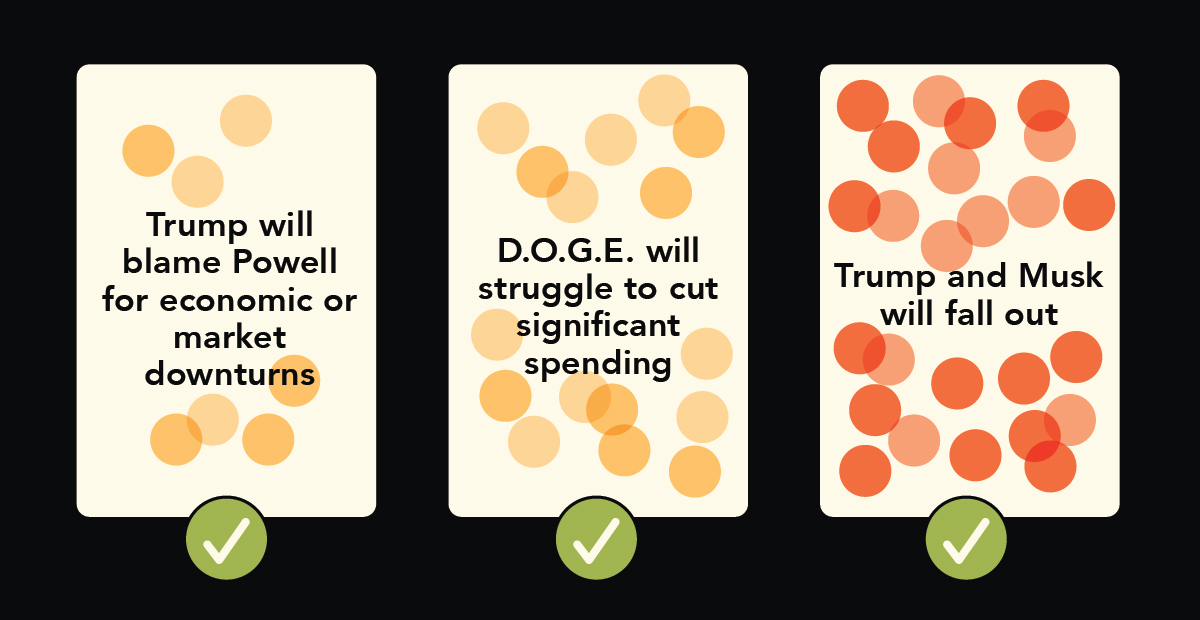

While Trump has been fairly unpredictable during the first six months of his presidential term, many experts read him right when it came to his relationship with Elon Musk and Federal Reserve chair Jerome Powell.

Even without any significant economic problems in the U.S., the president has been relentless in his demands for Powell to cut rates, already giving him the nickname of “Too Late” Jerome Powell.

Rather than blaming Powell for an economic downturn which hasn’t manifested yet, the focus has been on the interest payments of U.S. short-term debt, which would indeed fall if rates were cut.

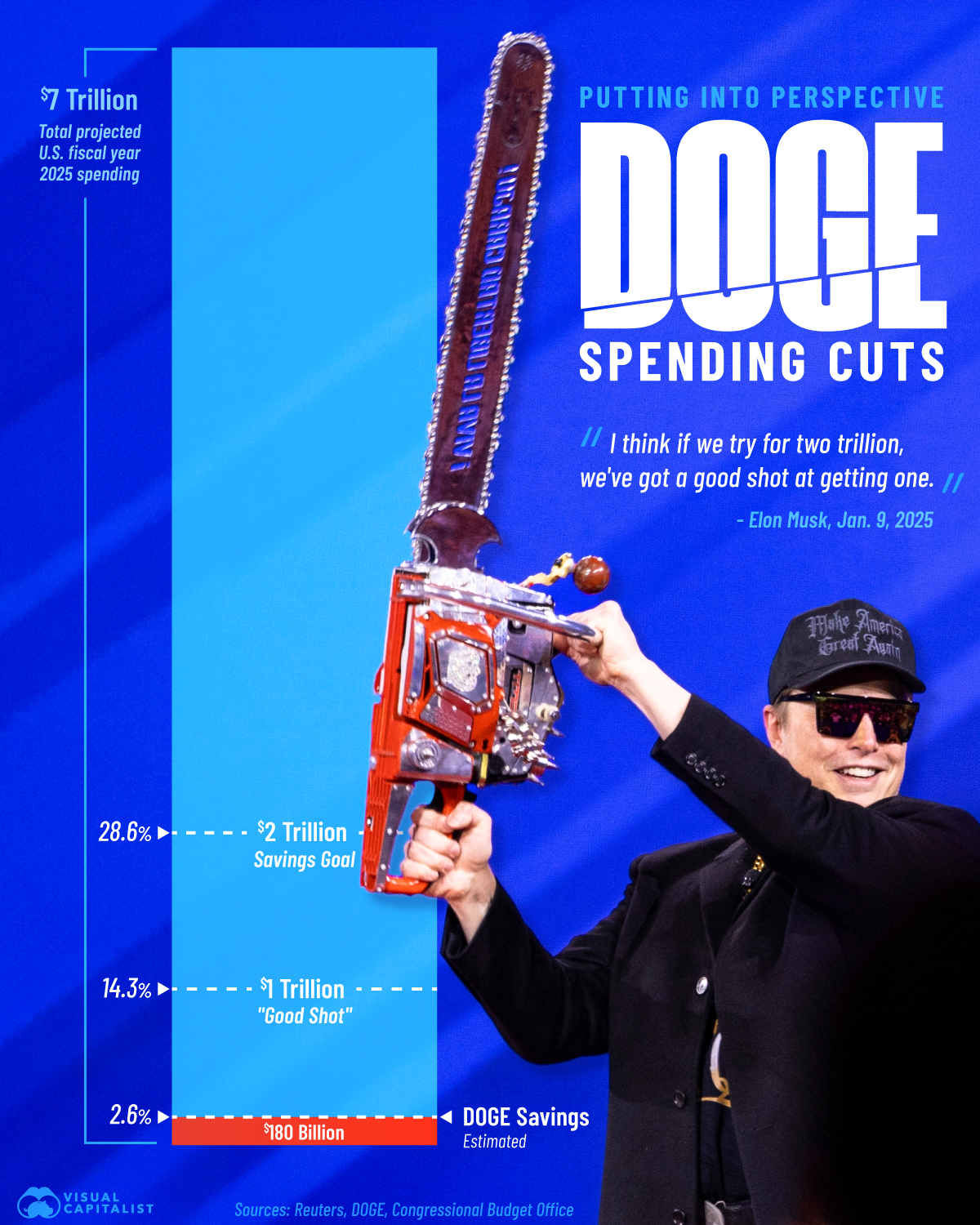

These cuts are even more needed for the budget considering D.O.G.E.’s inability to cut spending, along with the lack of spending restraint in Trump’s “One Big Beautiful Bill”, which is estimated to add $2.4 trillion to the federal deficit between 2025 and 2034.

Looking at Elon Musk’s goals for D.O.G.E.’s spending cuts, we can see just how little the organization managed to cut in comparison to the projected 2025 fiscal year spending of $7 trillion.

D.O.G.E.’s inability to make headway in cutting spending, along with Tesla suffering from Musk’s political involvement, led to Musk departing from the administration on May 30th.

Just a few days later, Musk posted on X his dissatisfaction with Trump’s bill, calling it a “disgusting abomination”, and following up with posts alleging Trump’s involvement with Jeffrey Epstein. Trump’s retaliation came in the form of threats of revoking federal contracts and calling Musk mentally unstable.

However, by the following week, Musk had apologized and expressed regret for his statements, with Trump ultimately saying he had “no hard feelings” about the matter.

Europe Shines Brighter Than the “Not so Magnificent Seven”

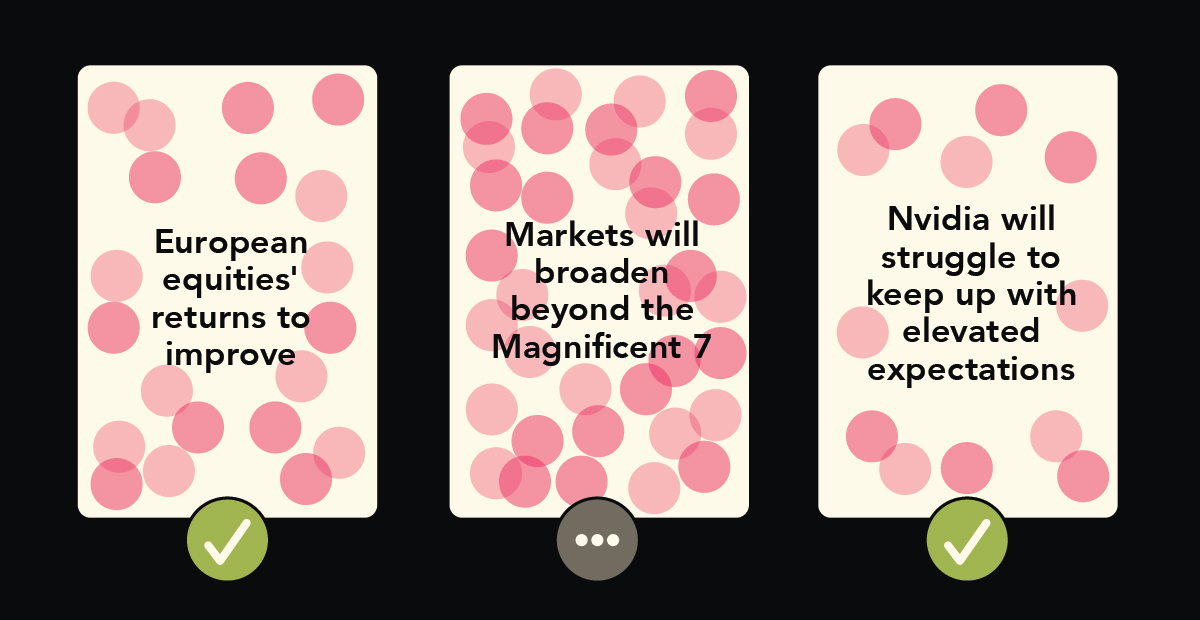

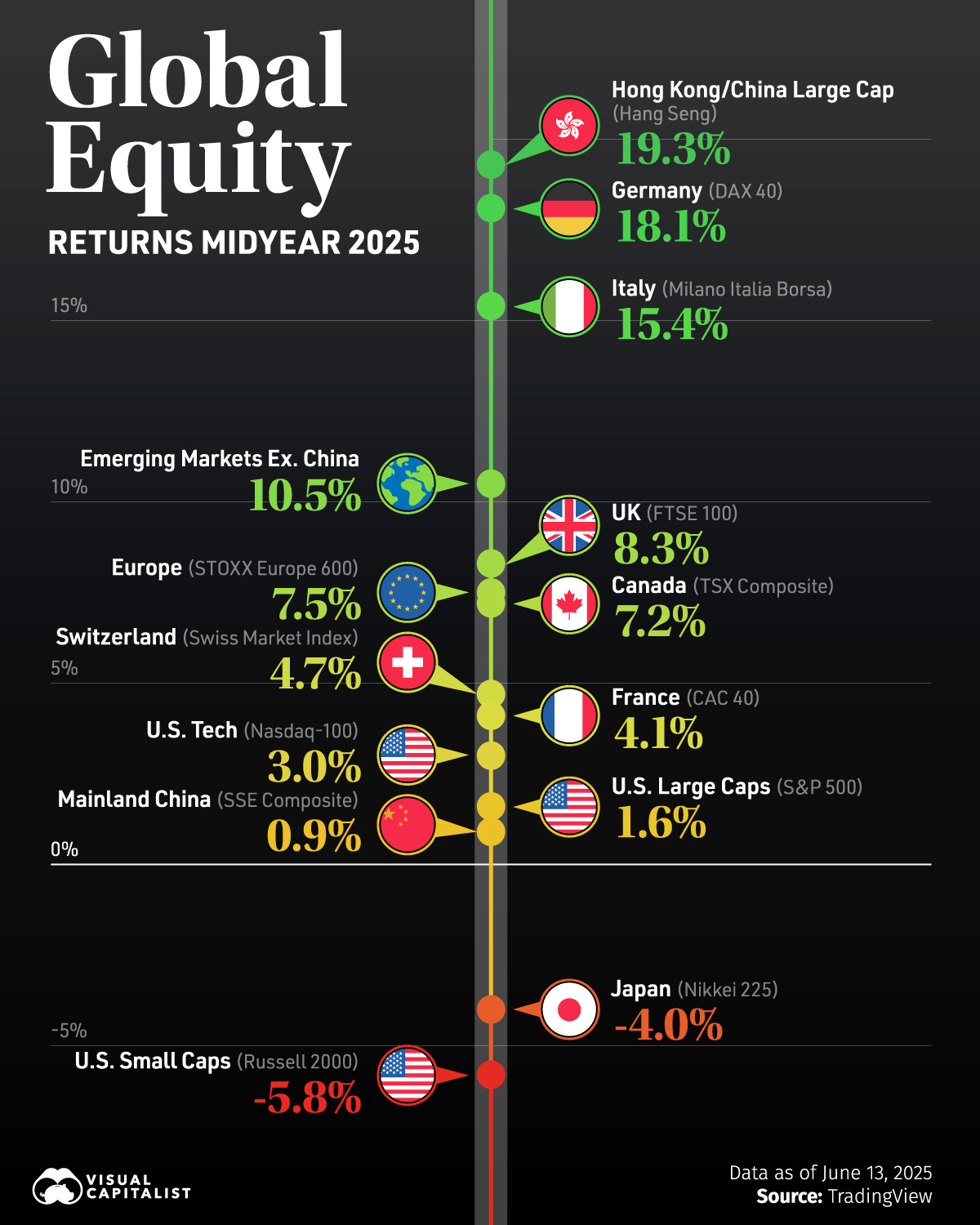

When it comes to the markets, while experts predicted European equities’ returns to improve, they probably didn’t expect to see them outperform quite this much as quickly as they did.

In the first two months of 2025 alone, Germany’s DAX 40 index rose 13.2%, Italy’s Milano Italia Borsa by 12.5%, and the UK’s FTSE 100 by 7.8%.

Europe’s equity indices have been among the best performing of 2025 so far, greatly outpacing both U.S. large cap and small cap indices.

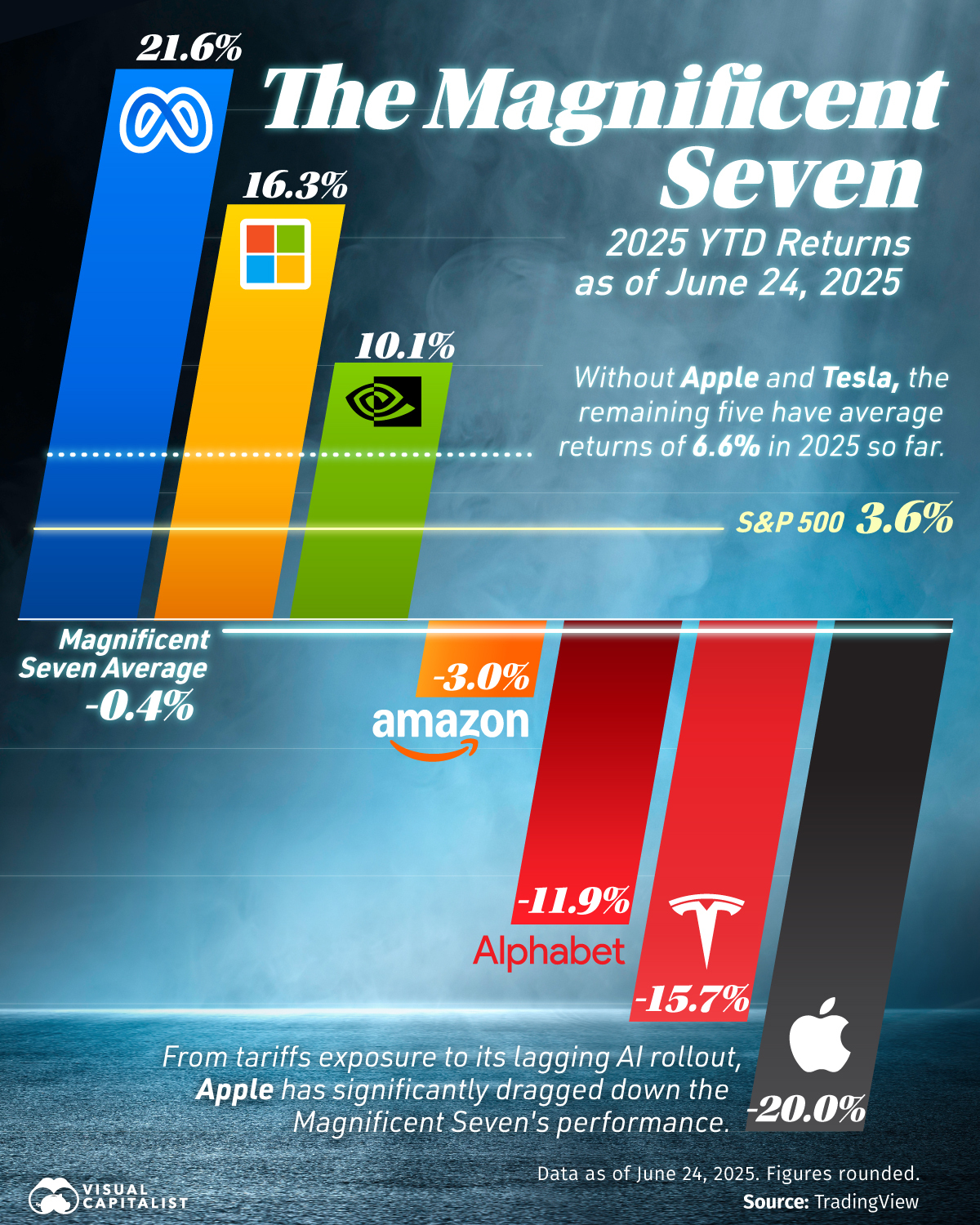

Amidst U.S. equity underperformance has been the mixed returns of the Magnificent Seven stocks, with significant divergences across the seven tech companies.

Apple and Tesla have suffered the most in 2025 so far. Musk’s political involvement has only hurt Tesla’s brand with non-Republicans and those outside of America, meanwhile, tariffs along with a late and poorly executed AI rollout have dragged on Apple’s returns.

For Alphabet, Google’s large capital expenditures on AI infrastructure are being seen as a drag on free cash flow which may not pay off. This hit to margins is coupled with revenue concerns from declining search usage due to ChatGPT’s rising popularity and the lack of a clear monetization plan for Gemini and Google’s other AI features.

If we look at Nvidia’s yearly returns since 2019 in the chart below, we can see that keeping up with the stellar triple-digit returns of 2023 and 2024 was a near impossible task for 2025.

While Nvidia’s growth has normalized from the breakneck pace of prior years, the company retains dominant market share when it comes to chip design. Along with this, the emergence of AI reasoning models and the development of agents have only increased the forecasts of token throughput and compute required.

Get the Full Midyear Predictions Update with VC+

Want deeper insights into how expert predictions across tech, geopolitics, and more are unfolding? Join VC+ to access the full breakdown—plus, get a free gift once you secure your lifetime membership.