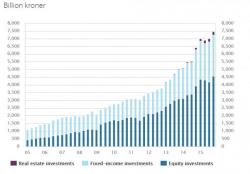

"The Government Is Crushing The Piggy Bank" - Norway Boosts Withdrawals From Its Sovereign Wealth Fund

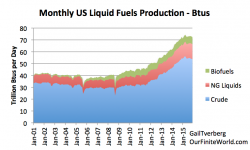

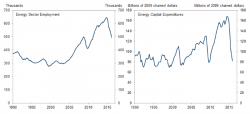

As it deals with the economic slowdown and a plunge in oil prices, Norway has turned to its massive sovereign wealth fund in order to cover 2016 budget deficits, in continuation of a trend noted here first last October. As Bloomberg reports, the country withdrew $898 million in March from the fund, putting the year-to-date total at roughly $3.1 billion, a run rate that is higher than the estimate the central bank governor gave just this past February.