Iraq On The Brink Of Chaos As Oil Revenues Fall

Submitted by Charles Kennedy via OilPrice.com,

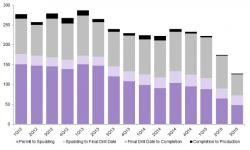

During a sombre visit to Germany last week, Iraqi Prime Minister Haider al-Abadi urged the international community to help boost his country's crisis economy in the face of plummeting crude oil prices, underscoring a desperate situation in which Iraq has lost 85 percent of its oil revenues.

Iraqi oil revenues have fallen to just 15 percent of what they used to be, the embattled prime minister said, despite a boost in production ordered last year.