The Man Behind The Oil Price Rally

Authored by Dan Dicker via OilPrice.com,

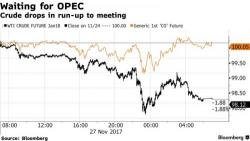

The OPEC meeting is over and the cartel has extended production cuts throughout 2018. The decision is obviously crucial to supporting oil prices, but perhaps an even bigger story is the relentless strategy from the young Saudi Prince, Mohammed bin Salman, being played out both inside OPEC and in his own country. And oil is the key to it all.