Futures Flat As Dollar Weakness Persists, Crude Rally Fizzles

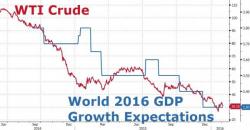

After yesterday's torrid, chaotic moves in the market, where an initial drop in stocks was quickly pared and led to a surge into the close after a weaker dollar on the heels of even more disappointing US data and Bill Dudley's "serious consequences" speech sent oil soaring and put the "Fed Relent" scenario squarely back on the table, overnight we have seen more global equity strength on the back of a weaker dollar, even if said weakness hurt Kuroda's post-NIRP world and the Nikkei erased virtually all losses since last Friday's surprising negative rate announcement.