OPEC Out Of Moves As Goldman Sachs Expects Another Oil Glut In 2018

Authored by Nick Cunningham via OilPrice.com,

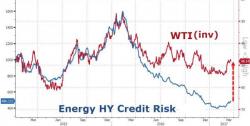

Oil prices are heading down again on swelling U.S. crude oil inventories, with Brent dropping below $50 per barrel for the first time this year.

The OPEC deal that has taken more than 1 million barrels per day of oil off the market has not succeeded in reversing this bearish trend for inventories. And with the deal at its midway point, focus is shifting towards an extension of the cuts through the end of the year.