Fasanara Capital: This Is The Bear Case For Oil

From Francesco Filia of Fasanara Capital

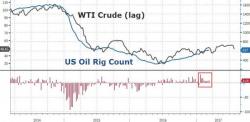

Oil: a weak present and no future

Oil correction (~10% from peak) is not necessarily the foretell of an imminent debacle. Oil corrected by approx. 20% twice in the past months (June-July 2016 and October-November 2016), without derailing the bull trend. Important supports were breached in both instances, and yet Oil managed to resurrect, powerfully.