WTI Tumbles To $51 Handle After OPEC Warns Glut May Continue Longer Than Expected

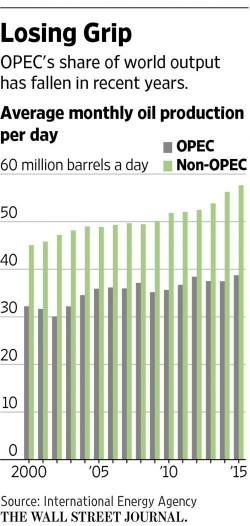

On the heels of last night's big crude build, OPEC's overnight report stating that supply cuts won’t re-balance the market until the second half of 2017 has sparked further losses in oil prices, almost erasing the entire OPEC/NOPEC/Saudi cut ramp.

As Bloomberg reports, OPEC said its agreement to cut production, while speeding up the re-balancing of the global oil market, won’t result in demand exceeding supply until the second half of next year.