What Does The Next OPEC Meeting Have In Store?

Submitted by Rakesh Upadhyay via OilPrice.com,

The next OPEC meeting on the 2nd of June will act as little more than a forum for continued altercations between Saudi Arabia and Iran.

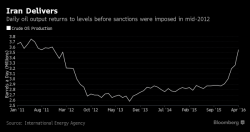

The 2 June 2016 OPEC meeting will be held amid a backdrop of oil prices near $50 per barrel, a sharp drop in Nigerian production due to sabotage, turmoil in Venezuela, Saudi Arabia operating with a new oil minister, and Iran aggressively pumping close to pre-sanction levels.