According To Credit Suisse, This Is The Only Thing That Matters To Markets

And, it will probably surprise no one, it has to do with president Donald Trump.

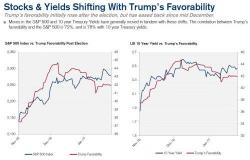

In a report by Credit Suisse analyst Lori Calvasina, to better understand the short term performance trends seen in the aftermath of the US Presidential election, and which trades may be most sensitive to shifting winds in Washington going forward, the Swiss bank analyzed how a handful of major macro indicators, stock market indices, styles, themes, sectors, and industry groups have been trading relative to trends in Trump’s favorability since the election, as tracked by Real Clear Politics.