JPMorgan Warns S&P Faces Large "Negative Gamma", Could Exaggerate Any Drop Next Week

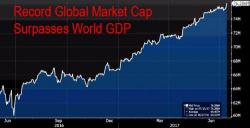

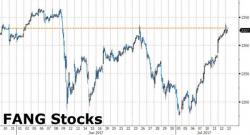

Earlier in the week we noted the 'odd' surge in downside protection demand even as tech stocks were soaring, and now JPMorgan is noting the S&P has shifted to a large 'negative gamma' underhang which "could boost volatility if we were to sell off."

As Bloomberg notes, options markets suggest a lack of confidence in the rally. Traders are piling into downside hedges on every uptick in prices...

And JPMorgan derivatives desk writes: