Evercore: If Markets Drop More, Don't Expect To Be Bailed Out By The Fed This Time

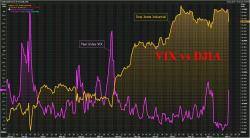

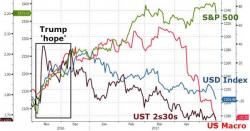

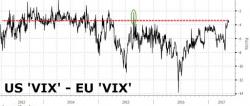

When we were discussing the self-reinforcing dynamics of vol-neutral funds yesterday, which may or may not continue selling today depending on what the VIX does, we concluded that aside from the decision-making mechanics of systematic funds, the biggest question would be if the Fed, or other central banks, do not do step in to prop up the market as they have on every other similar occasion in the past 8 years.

Would that imply that traders - be they CTAs, risk-parity, or simply carbon-based - are finally on their own?