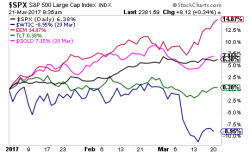

BofA: This Entire Rally Has Been Institutions Selling To "Animal Spirited" Retail Investors

Another paradoxical observation emerges when combing through the latest Bank of America data.

First, as discussed earlier today, while a net 48% of surveyed fund managers had an allocation to equities in March, the highest in two years, this flood into stocks has taken place even as the highest number of respondents since 2000 admitted stocks were overvalued.

That was one part.