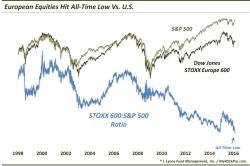

European Equities: Rolling Over…Or Overdue?

By Dana Lyons of My401kPro.com

In terms of global reach, the post-February equity rally has been a fairly broad advance. Some markets, most notably the U.S., have resumed their former relative strength while other regions, like emerging markets and Latin America, have seen strong mean-reversion bounces from very oversold levels, One region conspicuously lagging during this rally, however, has been Europe.