Weekend Reading: Bulls vs Bears - Who Will Win?

Submitted by Lance Roberts via RealInvestmentAdvice.com,

Submitted by Lance Roberts via RealInvestmentAdvice.com,

It has been a crazy year so far.

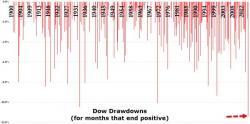

After what was the worst January for the stock market in recent memory, and a volatile but still difficult month for risk in February, the month of March saw a the biggest rebound from its lows in Dow Jones history, and a substantial bounce for the vast majority of risk assets with positive momentum a feature right up until month end.

So what were the best, and worst, performers in the month of March, and the first quarter? Here is the summary from Deutsche Bank:

Stocks are rolling over.

As we wrote about earlier this week, the S&P 500 was pushing for a final “kiss” of the broken bearish rising wedge pattern:

The next move should see us drop sharply.

Big picture stocks have effectively gone nowhere since QE 3 ended in November 2014. Yes it’s been a volatile ride, but all things considered stocks have largely traded sideways for 16 months.

Meanwhile, beneath this veneer of stability, the global economy has fallen off a cliff.

Last year (2015) marked the worst year for global trade since the Great Crisis.

For Japan, the post "Shanghai Summit" world is turning ugly, fast, because as a result of the sliding dollar, a key demand of China which has been delighted by the recent dovish words and actions of Janet Yellen, both Japan's and Europe's stock markets have been sacrificed at the whims of their suddenly soaring currencies. Which is why when Japanese stocks tumbled the most in 7 weeks, sinking 3.5%, to a one month low of 16,164 (after the Yen continued strengthening and the Tankan confidence index plunged to a 3 year low) it was anything but an April fool's joke to both local traders.

Submitted by Jim Quinn via The Burning Platform blog,