One Trader Reflects On A Bad Trade - The Never-Ending Grain Pain (And Whose Fault It Was)

Authored by Kevin Muir via The Macro Tourist blog,

I have had some bad trades in my day. But lately, one call has been especially atrocious.

Authored by Kevin Muir via The Macro Tourist blog,

I have had some bad trades in my day. But lately, one call has been especially atrocious.

U.S. equity index futures point to a higher open, having rebounded some 10 points off session lows with the VIX stuck on the edge between single and double digits, while European and Asian shares decline as investors assess central banks’ shift toward tighter monetary policy and concern over tax overhaul ahead of final plan.

It has been a groggy end to what is still set to be a third week of gains for MSCI’s global stock index following more upbeat data and signs that central banks including the Federal Reserve will keep treading carefully with interest rate hikes.

Did Senators Lee and Rubio (and Hatch) just go full "Leeroy Jenkins"?

A surprise China rate hike (and disappointing retail sales) sparked weakness in Chinese stocks...

Barely two months after JPMorgan's Marko Kolanovic previewed the next financial crisis, which he dubbed the "Great Liquidity Crisis", and which would be catalyzed by the following liquidity disrupting elements:

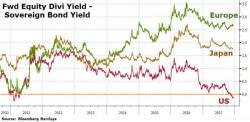

For almost 7 years, asset-gatherers and commission-takers have exclaimed "There Is No Alternative" to stocks, given how low interest rates are. However, given the recent buying-panic in stocks, TINA is now dead BAB is back (Bonds Are Better)...

In a sign the U.S. equity rally may be looking stretched, Bloomberg notes that the forward dividend yield on the S&P 500 has dropped below the return on Treasuries for the first time since 2011.