'Bricks & Slaughter' - Amazon Deal Slams Stocks As Yield Curve Crashes

Seemed appropriate...

Seemed appropriate...

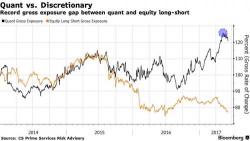

Two days ago, JPM's head quant made a striking observation: "Passive and Quantitative investors now account for ~60% of equity assets (vs. less than 30% a decade ago). We estimate that only ~10% of trading volumes originates from fundamental discretionary traders." In short, markets are now "a quant's world", with carbon-based traders looking like a slow anachronism from a bygone era.

In short, buy stocks.

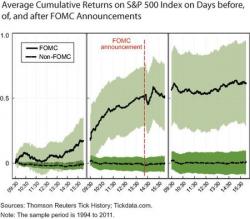

Remember that 2011 NY Fed study which found that since 1994, a stunning 80% of all equity returns on U.S. stocks were generated over the twenty-four hours preceding scheduled Federal Open Market Committee announcements, a phenomenon called the pre-FOMC announcement “drift.”

In his last interview as part of the Barron's Roundtable, from which he is retiring at the end of the year after three decades of participation, Felix Zulauf, owner of Zug-based Zulauf Asset Management had some parting words of caution.

Dude!! What's wrong with you brah?

While everyone wants to talk about what a great opportunity today was to BTFD in FANG stocks, we wanted to note one quick thing - US Macro data has crashed to 16 month lows...