Stocks & Bonds Slip As US Macro Slumps To 16-Month Lows

So... we have another terror attack in London, the biggest geopolitical earthqwuake in the Middle East in years, US macro data is dreadful... and stocks don't budge...

So... we have another terror attack in London, the biggest geopolitical earthqwuake in the Middle East in years, US macro data is dreadful... and stocks don't budge...

It’s risk-parity heaven right now, notes RBC's head of cross-asset strategy Charlie McElligott, with global equities (developed and EM) AND fixed-income all continuing their torrid rallies, but McElligott warns this is a classic "from worst to first" PM-grabbing into a new "Fear Of Missing Out" stage of the equities-rally.

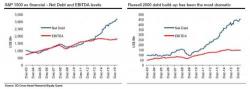

A recurring theme on this website has been to periodically highlight the tremendous build up in US corporate debt, most recently in April when we showed that "Corporate Debt To EBITDA Hits All Time High." The relentless debt build up is something which even the IMF recently noted, when in April it released a special report on financial stability, according to which 20% of US corporations were at risk of default should rates rise.

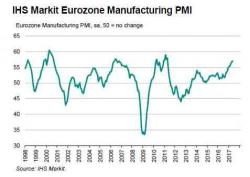

S&P futures are little changed this morning, while Asian shares rise and European stocks (+0.5%) are poised to snap a five-day losing streak amid a broad-based rally. The pound declined as better-than-expected manufacturing data failed to offset political risk before the impending election, while crude oil gained.

As one would expect, last week's report by Bank of America's Benjamin Bowler, in which the strategist stated that "these markets are very weird"...

... and in which Bank of America warned that "US equities continue to set long-term records for instability", prompted many questions from traders and investors.