Published

6 mins ago

on

April 25, 2025

| 763 views

-->

By

Ryan Bellefontaine

Graphics & Design

- Athul Alexander

The following content is sponsored by Vizsla Silver Corp.

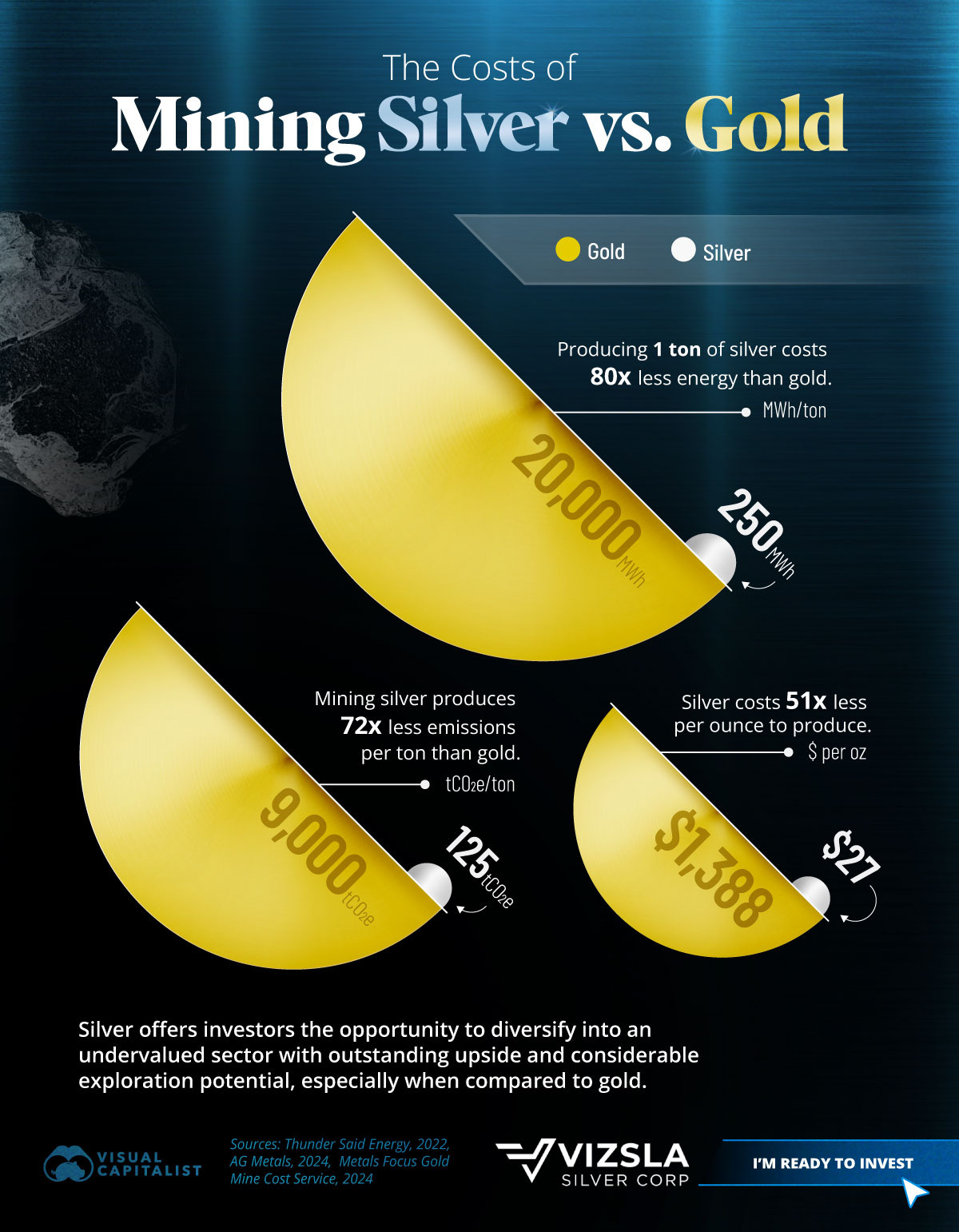

Charted: The Costs of Mining Silver vs. Gold

Key Takeaways

- Extracting one ton of gold requires 20,000 MWh of energy, compared to just 250 MWh for silver.

- Each ton of gold produces 9,000 tons of CO₂, while silver mining produces only 125 tons.

- Mining an ounce of gold costs approximately $1,388, compared to $27 per ounce of silver.

At first glance, gold’s higher price per ounce makes it seem like the obvious choice for miners. However, a closer look at production costs and environmental impact reveals why silver remains such an attractive metal to extract.

This graphic, sponsored by Vizsla Silver Corp., uses data from Thunder Said Energy, AG Metals, and Metals Focus Gold Mine Cost Service to compare the costs of mining silver vs. gold.

The Energy and Emissions Footprint

Gold mining is not only significantly more energy-intensive than silver mining but also produces many more emissions because of the increased energy intensity.

| Mining Metric | Silver | Gold |

|---|---|---|

| Energy Intensity (MWh/ton of metal) | 250 | 20,000 |

| Emissions Intensity (tons of CO2/ton of metal) | 125 | 9,000 |

| Production Cost ($/ounce of metal) | 27 | 1,388 |

Extracting one ton of gold requires 20,000 MWh of energy, compared to just 250 MWh for silver—an 80-fold difference. This vast energy demand translates into emissions: each ton of gold produces 9,000 tons of CO₂, while silver mining produces only 125 tons.

This stark contrast in energy and emissions highlights a key challenge in the gold industry. Despite its high market value, the environmental cost of gold extraction is dramatically higher than that of silver.

Production Costs: Bang for the Buck

The financial aspect further supports silver’s appeal. Mining an ounce of gold costs approximately $1,388, compared to $27 per ounce of silver. This means gold is 51 times more expensive to extract than silver when using the all-in-sustaining costs metric.

While gold prices are significantly higher, silver’s lower production costs indicate a more efficient return on investment.

Silver is a compelling alternative to gold when considering both environmental and financial factors. While gold is valued much higher, silver offers a more sustainable and cost-effective approach to mining.

Discover how Vizsla Silver Corp. promotes responsible mining practices to support the rising global demand for silver while building a sustainable future.

I’m Ready to Invest in Vizsla Silver Corp.

Related Topics: #mining #silver #gold #commodities #industry #investments #emissions #Vizsla Silver Corp.

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Charted: The Costs of Mining Silver vs. Gold";

var disqus_url = "https://www.visualcapitalist.com/sp/the-costs-of-mining-silver-vs-gold/";

var disqus_identifier = "visualcapitalist.disqus.com-176838";

You may also like

-

Commodities2 weeks ago

Charted: The End-of-Life Recycling Rates of Select Metals

End-of-life recycling rates measure the percentage of a material that is recovered at the end of its useful life, rather than being disposed of or incinerated.

-

Maps2 months ago

Mapped: Ukraine’s Mineral Resources

Ukraine claims to hold nearly $15 trillion worth of mineral resources.

-

Mining2 months ago

How Rich is Canada in Natural Resources?

Canada’s natural resources were valued at $1.7 trillion in 2023.

-

Mining2 months ago

Charted: Top Suppliers of Aluminum and Steel to the U.S.

President Trump has imposed a 25% tariff on all steel and aluminum imports.

-

Money2 months ago

How Much Gold Exists for Every Person on Earth?

Dividing all discovered gold (244,000 metric tons) by the the people (8 billion): how much gold does everyone get?

-

Mining2 months ago

Charted: The Global Mining Industry, by Market Cap

Australia tops the list, with its major mining companies totaling $353 billion in market cap.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up