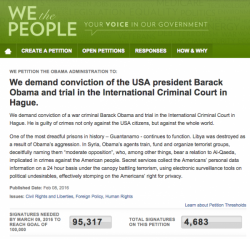

Thousands Of Americans "Demand" Obama Be Convicted Of War Crimes

When Barack Obama swept into the White House in 2008, the American electorate was hoping for “change.”

A “change” in the way Republicans and Democrats interacted with one another, a “change” in how the US is perceived by the rest of the world, and a “change” in Washington’s notoriously poor foreign policy in the Mid-East.