Volatility: A Misleading Measure Of Risk

Authored by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

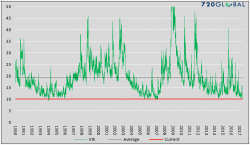

“History has not dealt kindly with the aftermath of protracted periods of low risk premiums” – Alan Greenspan

Authored by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

“History has not dealt kindly with the aftermath of protracted periods of low risk premiums” – Alan Greenspan

One day after Bloomberg commentator Richard Breslow looked at the market's big picture and said that "Traders Increasingly Have No Idea What's Going On", the former trader slammed the daily narrative flip-flopping by rangebound traders who goal seek the newsflow to justify any and all positional shifts, not to mention "following the price", saying that "not every change in asset prices signals a new and lasting paradigm shift."

As expected, there were no fireworks in the Fed statement which on balance was rather hawkish thanks to the Fed's explicit assurance that recent weak data was "transitory" (we wonder how the "data-dependent" Fed will react if the weakness is not transitory). And as the Wall Street reactions start trickling in, the consensus is that the Fed remains on "autopilot" until June, when it will hike once again.

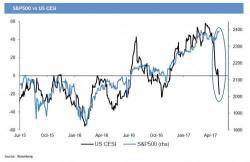

Having perfectly top-ticked US economic data with its March rate-hike, the subsequent collapse in 'data' has been shrugged off as transitory (or seasonal) and by all indications The Fed seems set on two more rate hikes this year no matter what (even as the market diverges dovishly).

Today's FOMC announcement at 2:00pm is expected to be mostly a non-event, and the only incremental information will be what is contained in the updated statement, which comes one month ahead of the Fed's next expected rate hike in June. There will be no press conference and no update to the summary of economic projections. The statement is expected to incorporate modest changes to reflect recent (mixed) data but see the risks around the meeting are low.

Here is what Wall Street consensus looks like ahead of 2pm: