In An Unexpected Outcome, Trump Tax Reform Just Blew Up The Treasury Market

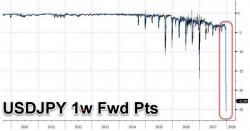

Over the past week we have shown on several occasions that there once again appears to be a sharp, sudden dollar-funding liquidity strain in global markets, manifesting itself in a dramatic widening in FX basis swaps, which - in this particular case - has flowed through in the forward discount for USDJPY spiking from around 0.04 yen to around 0.23 yen overnight. As Bloomberg speculated, this discount for buying yen at future dates widened sharply as non-U.S.